Ever wonder how a broker earn $ to keep up their services? Most them earn their funds for management and maintenance through a fraction of each and every trade we take. This fraction is also known as spread, the fractional difference between the buy and sell. The spread we pay to the broker is the fee they take to maintain their services. Certain STP/ECN broker have very low spread as little as 0.0 - 0.1 pip, this is possible because for each trade a certain fix commission is charged.

Example, Armada Markets charges $2 for every 1 lot traded. This $2 is the commission charged by Armada Markets to its trader.

At times, the brokers take a part of these fees and pay individual that help introduce new future customer/traders to their team. This is more commonly known as "Introducing Broker" or "IB". An obvious example is the IB that I have setup with Armada Markets which gives us back 5% of the commission we have to pay for our trade.

Example: If you open an account with Armada Markets through the link below, you will obtained an instance 5% rebate of the $2 commission paid for each 1 lot. $2 - 5% = $1.9. That is a saving of 10 cent for every trade, it does pile up to a lot of money eventually. [Register here]

----

There are many ways to receive these rebate/cashback; for other brokers I truly love CashBackForex. They have help me save up a lot of money. Do register an account with CashBackForex and open an account with one of their listed brokers. Contact me if you need help getting setup after you have register. [Register here]

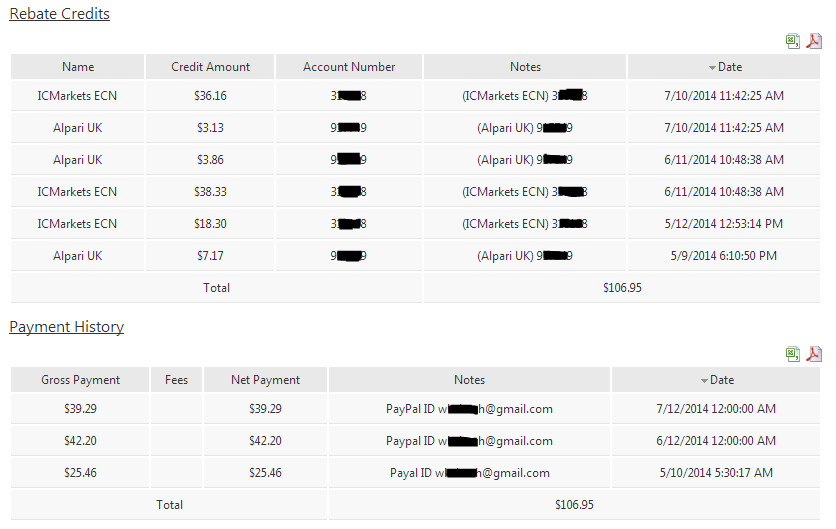

I have many friends who were initially skeptical of such too good to be true news. Why would someone refund you a fraction of the fee paid to them for trading. The answer is, they want referral and also they want traders to trade more. Either way.. a picture carry more weight than words.. below are screenshot of previous refund given by CashBackForex to my Paypal.

Net rebate to date

Previous rebate and payment

Rebate realized in Paypal account

Well believe it or not is your choice, but I gain an extra $106.95 for trades I took win or lost. This is a lot of money. So if anyone is interested to follow my foot steps.. signup and buzz me. I would be more than willing to help those who register as my referral. [Register here]

-DC