As I've been publishing my signals for people to follow [

Click Here]. With that I been asked many times what is a proper account size and leverage do I use. This question is also common for many who wish to start trading. I am writing this out so that instead of replying post after post of the same question, putting this down in an entry here would allow others to get my answer to those question here.

- What 'Account Size' should we start with?

My personal preference is $1000, or for others is the amount that they are willing to lose. Pick an amount that you are comfortable in losing. Before we begin to make money, you have to understand that there are loses. So we always start off with what we can and able to lose. This usually is the bonus from work or a fraction of your savings. Never ever invest with your next month's rent. You would be digging your own grave if you do.

- What 'Leverage' capacity should we use?

I select broker with 1:400 or 1:500 leverage. Leverage trading is very risky, but like a sharp knife is safer than a blunt one when used properly; a huge leveraged account can be very beneficial to someone who use it well.

----

So why $1000 and 1:500 leverage. I do not trust brokers with my hard earn cash. There are a few reason why I started my $10,000 challenge with only $1000.

- I believe if you can trade, you can make $1000 to $10000. If you cant trade, even if you have $100,000 it would just get burnt up. I also have little trust with brokers or organization that is intangible.

- Offshore brokers are organization that all I have is address, contact number and reviews from strangers. How can I trust them with more money than I can part. It does feel like leaving your money with a stranger on the street to hold while you count your coins to pay a merchant, obnoxiously unsafe.

- The emotional sanity of trading is the final reason why one should start trading with a small account. If you are not use to losing $100, you will never be able to accept losing $1000.

I am going to touch more on emotional sanity of trading. It is very important to understand this before we trade our life savings away. When a draw-down happen it can last for weeks at time months. If you are not use to seeing your account in red and still smile at the next person that greet you, you will never be able to accept a materialized lost of investment you have took.

I knew if I did not get use to losing $100s I will never be able to accept lost in $1000s. There is no way I could start trading with a $10,000 account and accept a lost of 10% = $1000.. There will always be days you win and days you have to accept loses. My current largest materialized lost is $977. As I start my journey, the first thing I made myself learn is to accept losses. This is why I force myself to start trading with a small account to get use to the amount of wins and lost.

Initially I took my loses badly, I would lose my temper and sulk for days when my account was having a draw-down. It wasn't healthy nor was it fair for the people around me. With time and patience the emotions of trading start to subside. I was soon able to accept draw-dawn of up to $7000 and not panic and lose my temper. Although $7000 was about 30% of my account at that point of time, it was still a huge sum. If I have not started to experience small loses I wouldn't have been able to still be calm and trade with discipline with such a huge draw-down.

There is a trick to it.. Here is my little secret to success.. When I trade I don't look at value of a position but its growth % or points(pips). This is why it was important to use leverage correctly. Over trading would cause one to burn their account faster in a draw-down. Being able to enter a large position doesn't mean you should. Leverage for me is like extra funds, a capability to hold back the draw-down faced on a bad entry.. I never enter an extra trade when my leverage % reaches 800%, even if the trade setup is a sure win. Self control is one trait you must have at trading. I would curse later that I miss it, but never will I enter a position when my leverage % is lower than 800%.

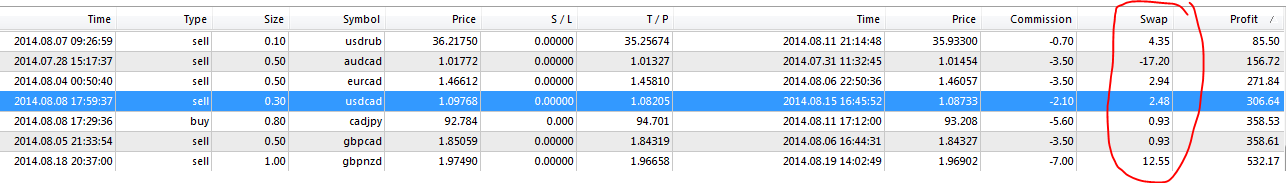

I also always trade based on points/pips. I exit a position based on the desired signs on the graph. I monitor my trade and smile based on the number of pips I get. I re-enter a position to average out the price only when the first entry are 80-100 pips apart or another signal is shown. I never get emotional and see $500 bucks profit and start closing the position. Only looking at your position in pips helps prevent me from closing my position before it mature. Monitoring a draw-down in pips also removes the emotional attachment to a potential lost. Pip trading and % have allow me to trade more like a robot. It help reduce the emotional stress of a current draw-down and the excitement of a current win.

With that I wish you all the best in your personal trading.. only when you can remove the emotions when trading, you will not be able to trade the way you want to.

-DC