Example when you buy AUDCAD you will be earning a specific interest/swap for the entry; but if you sell AUDCAD you would be paying a specific interest/swap to the position take.

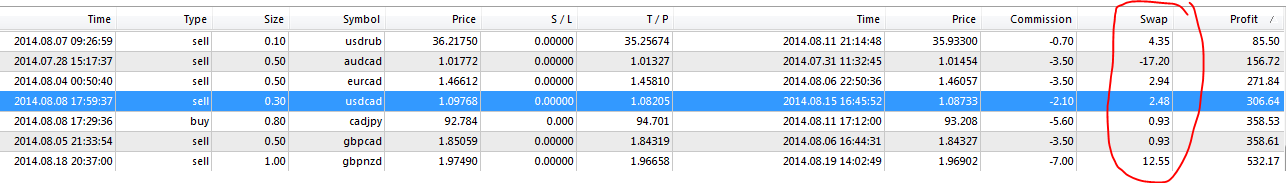

Below is a screenshot of swap payment / benefit from some of my previous trade. Notice the swap column. If a trades is open over a day it would incur swap. You either earn money holding a position or lose money holding it.

Swap rate can really kill you, if you are trading against swap it would be best to exit the trade early. If you are trading with swap for you, this would allow you to hold a position much longer.

How to find out the swap rate and its direction for the trade.. below is some screenshot that will help you along the way.

1 - From the Market Watch section, right click and select Symbols.

2 - From the Symbol window, select the pair you wish to understand better. Click on 'Properties'. Another window will popup. Look for Swap Long/ Swap Short, that will show you the swap value if it is positive or negative.

-DC

I also have doubt regarding swap. But with the help of this such informational blog I know what is it exactly. Thanks for sharing.

ReplyDelete